Wealth First explains how spreading investments shields you from the risks that target individual companies or sectors.

In our last discussion, we explored how diversification acts as the simplest insurance against uncertainty. But let’s look closer at what kind of uncertainty diversification actually protects us from.

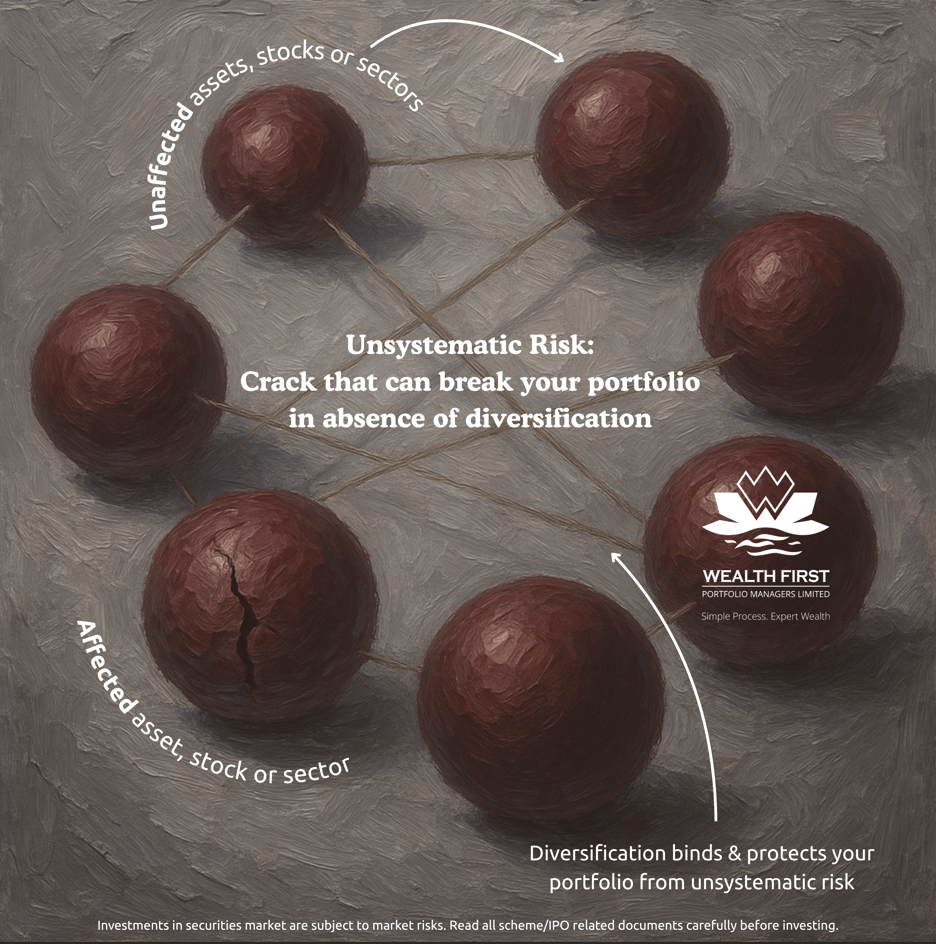

This brings us to a critical concept in investing—unsystematic risk.

What Is Unsystematic Risk?

Unsystematic risk refers to the risk that is unique to a particular company, industry, or sector.

It’s the kind of risk that arises from factors like:

- Poor company management or governance.

- A product failure or loss of market reputation.

- Industry-specific downturns (e.g., technology slowdown, commodity price crash).

In short, it’s the avoidable portion of investment risk as it affects some companies, but not all. If systematic risk is like a storm that hits everyone, unsystematic risk is a leak in your own boat. As unsystematic risk, is specific to company or sector—unlike market-wide risks— it can be reduced or eliminated through diversification.

The Role of Diversification

Diversification is your best defence against unsystematic risk.

When you spread your investments across different companies, sectors, and geographies, the fall in one stock doesn’t drag your entire portfolio down.

For instance:

If you only invest in one automobile company and it faces a regulatory issue or supply chain crisis, your returns suffer.

But if your portfolio also holds IT, pharma, and banking stocks, the overall impact remains limited. Diversification doesn’t remove risk. It distributes it intelligently.

Three Investors, Three Outcomes

Consider three friends Riya, Rina and Rima; all with different approach to investing in markets.

- Riya invests everything in one company. When that company’s profits fall, her portfolio value plunges 30%.

- Rina holds five companies from one sector (say, real estate). A policy change hits the sector; all stocks held by her decline together.

- Rima spreads investments across multiple sectors like financials, FMCG, IT, and manufacturing. Therefore, losses in one area are balanced by gains in another.

Result: Rima’s portfolio stays resilient, proving that diversification is the best antidote to unsystematic risk.

Consequences of Ignoring Unsystematic Risk

Failing to diversify can lead to:

- Concentration risk: too much dependence on a single investment.

- Permanent capital loss: if that company fails, recovery may be impossible.

- Emotional stress: volatility feels amplified when your portfolio isn’t well spread.

Even experienced investors can fall into this trap by believing that familiarity equals safety. But in investing, concentration magnifies mistakes; diversification cushions them.

The Balance Between Focus and Safety

While diversification is essential, over-diversifying (holding too many investments) can dilute returns.

The key lies in thoughtful diversification that is enough spread to minimize risk, but still focused enough to generate meaningful growth.

This balance is best achieved through a well-planned asset allocation strategy, aligned with your risk tolerance as discussed in our earlier Wealth First Explains articles.

Key Takeaways

- Unsystematic risk is company- or sector-specific and can be reduced through diversification.

- It differs from market risk, which affects all investments.

- A well-diversified portfolio prevents one failure from derailing your entire plan.

- Combine diversification with proper asset allocation and risk awareness for lasting stability.

👉 Use our Wealth Calculator to plan and test your asset mix.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information.