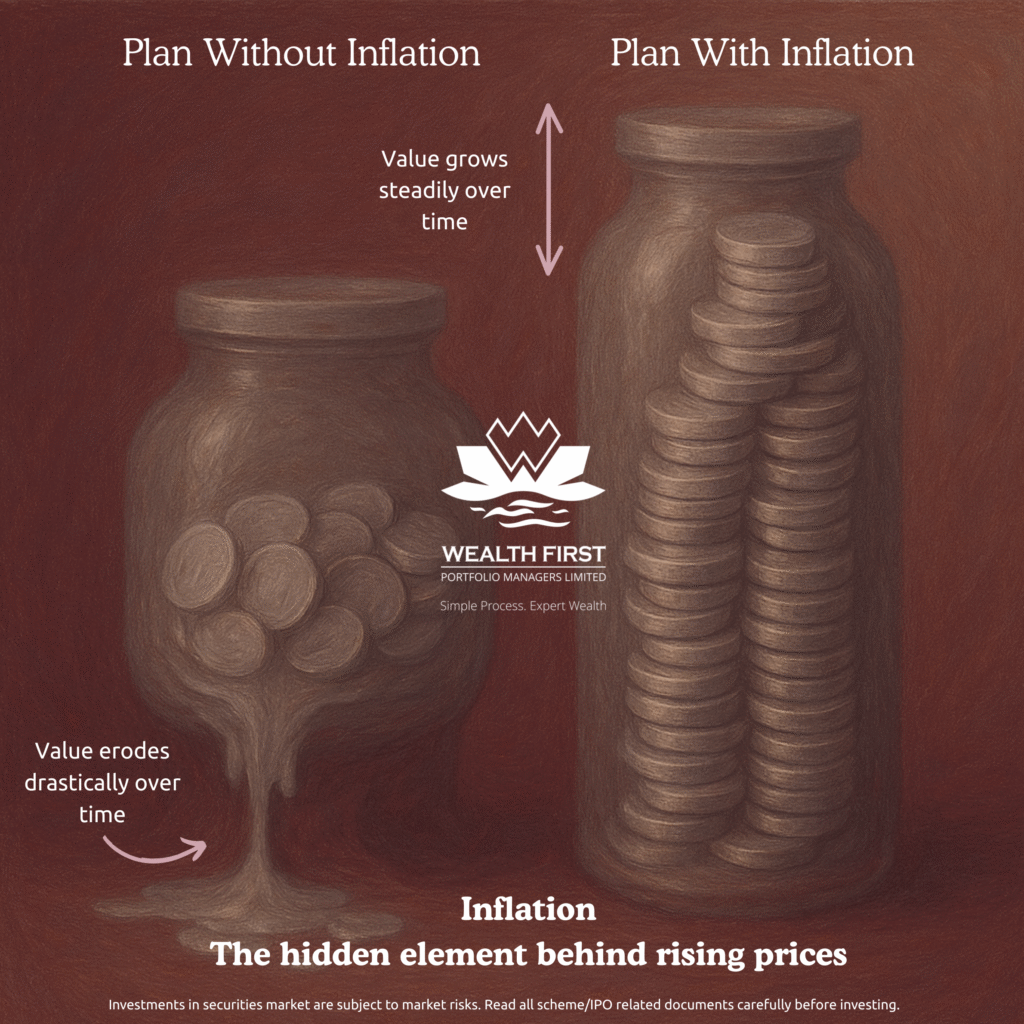

When we think of financial planning, most people calculate their goals based only on today’s prices. But there’s a hidden force quietly working against us: inflation. It is the single biggest hurdle in achieving financial goals, and ignoring it can mean falling short—even if you save regularly.

What is Inflation?

In simple terms, inflation is the rise in prices of goods and services over time. That means the same amount of money buys less in the future than it does today.

For example, a family vacation costing ₹1,00,000 today may cost ₹1,50,000 a few years later. Unless your savings grow faster than inflation, your wealth loses value.

What Causes Inflation?

Inflation isn’t random—it is driven by multiple factors, such as:

- Demand and supply mismatch – When demand for goods is higher than supply, prices rise.

- Increase in production costs – Higher wages, raw materials, or energy costs push up prices.

- Government policies – Taxation, subsidies, or monetary policies can fuel inflation.

- Global factors, including oil prices, currency fluctuations, and international trade, all play a role.

- Expectations – When businesses and consumers anticipate higher prices in the future, they often adjust wages and costs upward, further fueling inflation.

Why Does Inflation Matter for Your Goals?

Let’s take a simple goal: you want ₹10 lakh for a milestone 10 years from now.

Case 1: Ignoring Inflation

- Goal Cost Today: ₹10,00,000

- Time Horizon: 10 years

- Inflation: 0%

- Expected Return: 10%

- Required Monthly SIP: ₹4,882

- Total Invested: ₹5,85,809

- Future Goal Amount: ₹10,00,000

Case 2: Accounting for Just 2% Inflation

- Goal Cost Today: ₹10,00,000

- Time Horizon: 10 years

- Inflation: 2%

- Expected Return: 10%

- Required Monthly SIP: ₹5,951

- Total Invested: ₹7,14,098

- Future Goal Amount Needed: ₹12,18,994

With just 2% inflation, you must save an extra ₹1,069 every month for 10 years!

Now imagine if inflation is closer to India’s current level of 4.2% (Source)

- Future value of your ₹10 lakh goal = ₹15.08 lakh (approx. with 10% growth rate)

- The required monthly SIP would rise even higher (₹7,366) to match that target.

This shows why ignoring inflation in planning is one of the costliest mistakes an investor can make.

How to Beat Inflation

The good news is that you can plan smarter:

- Always factor inflation into your financial planning.

- Invest in assets that outpace inflation (equities, mutual funds, PMS/AIF, depending on risk appetite).

- Use tools like the Wealth First Goal Calculator to adjust for inflation before setting your SIP.

- Review goals periodically—as inflation and returns change over time.

Key Takeaways

- Inflation silently reduces the future value of money.

- Even small inflation (2–4%) significantly increases the amount you need to save.

- Smart investing, not just saving, is essential to preserve and grow wealth.

At Wealth First, we help clients design financial plans that account for inflation—ensuring their goals remain achievable, not just on paper but in reality. Talk to Us to create a plan that keeps your wealth growing, despite rising prices.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information. By subscribing to or engaging with our content, you acknowledge that you are doing so at your own discretion, and that Wealth First is not responsible for individual investment outcomes.