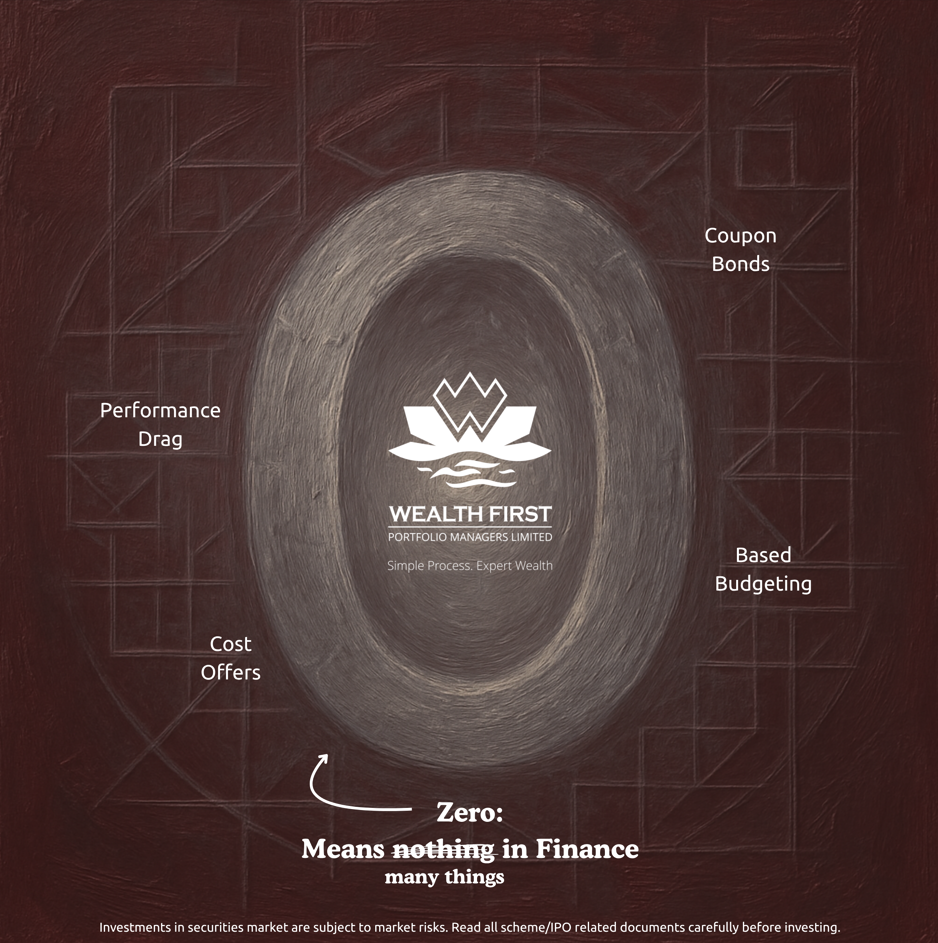

Wealth First explains why ‘zero’ has some of the deepest meanings in money and investing.

“Zero looks like nothing, but it changes everything.”

Imagine two identical portfolios: both earn the same gross return, but one trims unnecessary costs closer to zero. Over years, that difference quietly compounds into a meaningful lead.

From bonds to budgets and even “zero-cost” offers, the number zero appears everywhere in finance; sometimes as a strength, and sometimes as a warning. Let’s explore where zero matters, and how understanding it can make you a smarter investor.

1. Zero-Coupon Bonds: Growing Silently, Predictably

What they are:

Zero-coupon bonds are issued at a discount and do not pay periodic interest. Instead, you receive the face value at maturity.

Why it matters:

They offer a clear, time-defined maturity value, thereby making them useful for specific goal timelines (like education or a planned expense).

Example:

You invest ₹70,000 today in a 10-year zero-coupon bond that matures at ₹1,00,000. The difference represents your implied annual yield.

Risks to note:

- Interest rate risk: Prices may fluctuate before maturity.

- Credit risk: The issuer’s quality matters.

- Reinvestment risk: Near-zero, since there are no interim coupons.

Context:

Zero-coupon bonds fit within the debt portion of an investor’s allocation, especially for goal-based investing when the maturity matches the goal date.

2. Zero-Based Budgeting (ZBB): Every Rupee Has a Role

The idea:

In zero-based budgeting, every rupee of income is assigned a purpose — whether for expenses, savings, or investments. By month-end, unallocated cash should ideally equal zero. It is a technique used by mainly by companies, but individuals and families can certainly use it as well.

Why it helps:

This approach improves awareness and reduces wasteful spending, often freeing up room for consistent investments.

How to begin:

Start by splitting income into three buckets:

- Needs – essentials like rent, utilities, groceries, etc.

- Goals – SIPs, insurance, emergency fund, etc.

- Lifestyle – discretionary spending

Review monthly to refine proportions as the process of budgeting starts at zero for every new period.

3. Zero-Cost Offers: When “Free” Isn’t Free

In finance, “zero” often features in advertisements such as zero-cost EMI, zero brokerage, zero commission. But zero rarely means nothing.

What to watch for:

- Zero-cost EMI: Interest may be hidden in the price or offset by processing fees.

- Zero brokerage / commission: Platforms may charge through spreads, maintenance, or transaction fees.

- Zero down-payment: The cost is deferred, not erased, which affects cash flow and savings capacity.

If you don’t see the cost, look harder. While not always the case, “zero” in ads often means hidden somewhere else.

4. (Near) Zero Performance Drag: The Invisible Cost to Reduce

“Performance Drag” in investing is the quiet reduction of returns caused by costs such as expense ratios, transaction charges, idle cash, tax churn, etc.

The goal: One shall try to move drag closer to zero, to retain more of what the portfolio earns. It is not possible to completely eliminate certain charges and costs as they are charged by those offering those services. Even a 1% annual drag over 10 years can create a significant gap in wealth compared to a 0.3% drag purely from efficiency.

How to reduce drag:

- Use appropriate, cost-efficient investment vehicles.

- Rebalance periodically, not reactively.

- Keep emergency cash separate to avoid performance drag in your core portfolio.

- Plan withdrawals and taxation efficiently.

6. Key Takeaways

- “Zero” in finance isn’t nothing. It can be a goal (in costs, drag) or a feature (in bonds, budgets).

- Zero-coupon bonds simplify long-term goal matching but carry rate and credit risks.

- Zero-based budgeting improves financial control and investment discipline.

- Zero-cost offers require scrutiny. Always check total costs breakup of what you are paying.

- Reducing Performance drag brings you closer to your real investment potential.

In wealth, as in life, the power of zero lies not in absence, but in efficiency.

To explore more simplified concept explainers around investing and finance, visit the learning and calculator sections on the Wealth First website.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, recommendation or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information.