Wealth First explains why flexibility and access to money matter as much as growth.

Water has been a recurring theme in our recent discussions: waves of volatility, the umbrella shielding us from financial downpours, and the flow of investments across multiple streams in diversification.

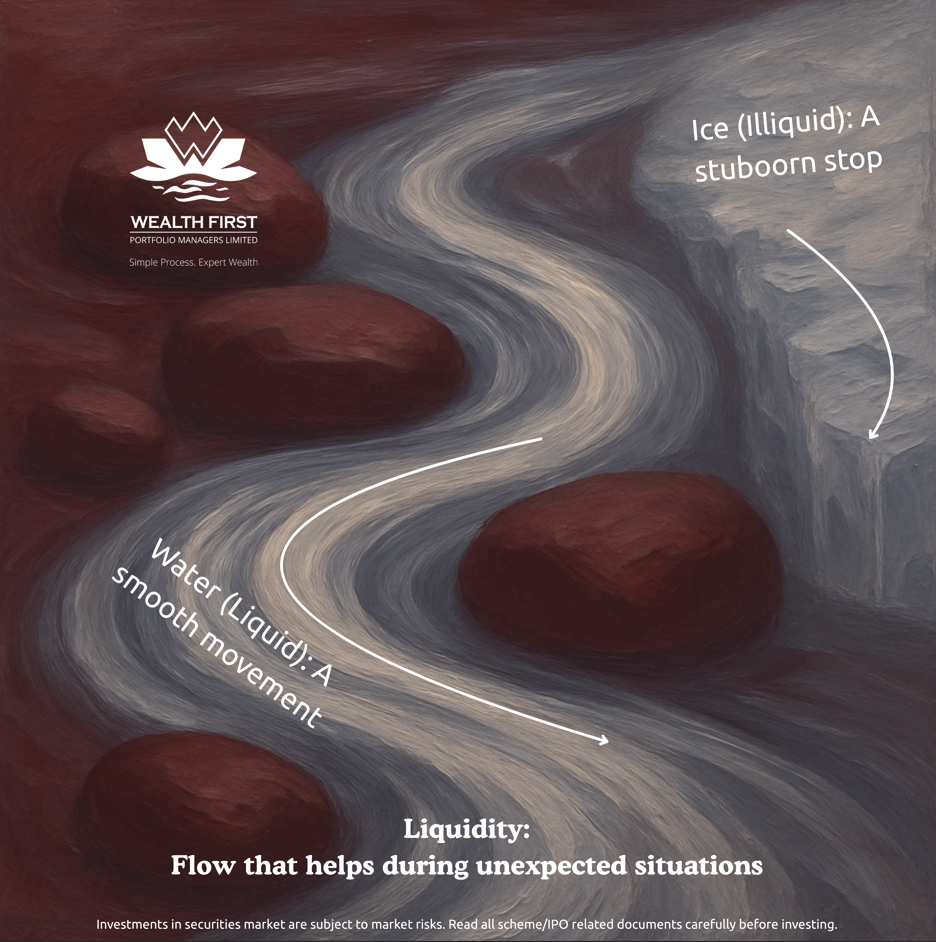

Now, let’s focus on what makes water most powerful: its ability to move swiftly. In finance, that movement is called liquidity.

What Is Liquidity?

In simple terms, liquidity is how quickly and easily your wealth can be converted into cash without losing much of its value.

Cash is the most liquid form of wealth. It can move instantly.

Assets like real estate, art, or long-term locked-in investments are illiquid as they take time to sell or redeem.

Liquidity is your wealth’s ability to move when you need it the most.

Why Liquidity Matters

Imagine water stored across various containers—some in bottles (cash), some in tanks (mutual funds), and some frozen in ice (real estate). When an emergency arises, you can drink from the bottle, not the ice.

Similarly, during life’s uncertainties—medical emergencies, sudden expenses, or opportunities—liquid wealth lets you act swiftly without breaking long-term assets or taking on debt.

A Tale of Two Investors

Sagar maintains a well-structured wealth plan. He has:

- 6 months of expenses in a liquid mutual fund (his emergency fund).

- Short-term goals invested in short-duration debt funds.

- Long-term goals growing steadily in equity.

When his car unexpectedly needs ₹1.2 lakh in repairs, he simply redeems a portion from her liquid fund—instantly, without touching his investments or borrowing money.

Sheetal, on the other hand, invested all her money in real estate and long-term equity funds. When faced with a sudden medical emergency, she struggles to arrange funds quickly. She ends up taking a personal loan at a high interest rate.

Both are disciplined investors—but one understood liquidity, and the other didn’t.

Maintaining Liquidity Without Losing Value

The challenge is to strike a balance by keeping enough liquidity for emergencies, but not so much that your money loses value due to inflation.

Here’s how:

- Use liquid mutual funds – earn modest returns while keeping instant access.

- Maintain staggered deposits – short-term FDs for predictable needs.

- Regularly review – as expenses and lifestyle change, your liquidity buffer should too.

Think of liquidity like flowing water—keep it moving, but always within reach.

When Liquidity Turns Excessive

Too much liquidity can hinder long-term growth. Money sitting idle in low-yield accounts loses purchasing power to inflation.

That’s why liquidity must be purposeful, not habitual. A sound wealth plan ensures your cash flows freely when needed, but continues working efficiently otherwise.

Liquidity, Risk, and Growth

Liquidity connects the dots between everything we’ve learned:

- It balances risk tolerance (comfort and access).

- It supports asset allocation (ensuring each goal has the right vehicle).

- It complements insurance and diversification (offering flexibility during shocks).

When your wealth is liquid enough, it stays ready to move, adapt, and protect your future.

Key Takeaways

- Liquidity means accessibility—how fast wealth can move when needed.

- Keep a part of your wealth liquid through cash, short-term debt, or liquid funds.

- Insufficient liquidity can force distress selling or borrowing.

- Over-liquidity can reduce real returns due to inflation.

- The right balance keeps you secure and flexible.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information.