Wealth First explains why smart investing often looks worse before it gets better and how understanding the J-curve can help you stay the course.

Have you ever started a new investment plan like a SIP, a portfolio, or even a savings habit, and found yourself thinking after a few months,

“Why does my plan look worse now than when I began?”

If yes, you’ve already experienced what’s known in investing as the J-curve effect.

It’s one of the most important behavioural patterns to understand — not just in finance, but in life itself.

What Is the J-Curve?

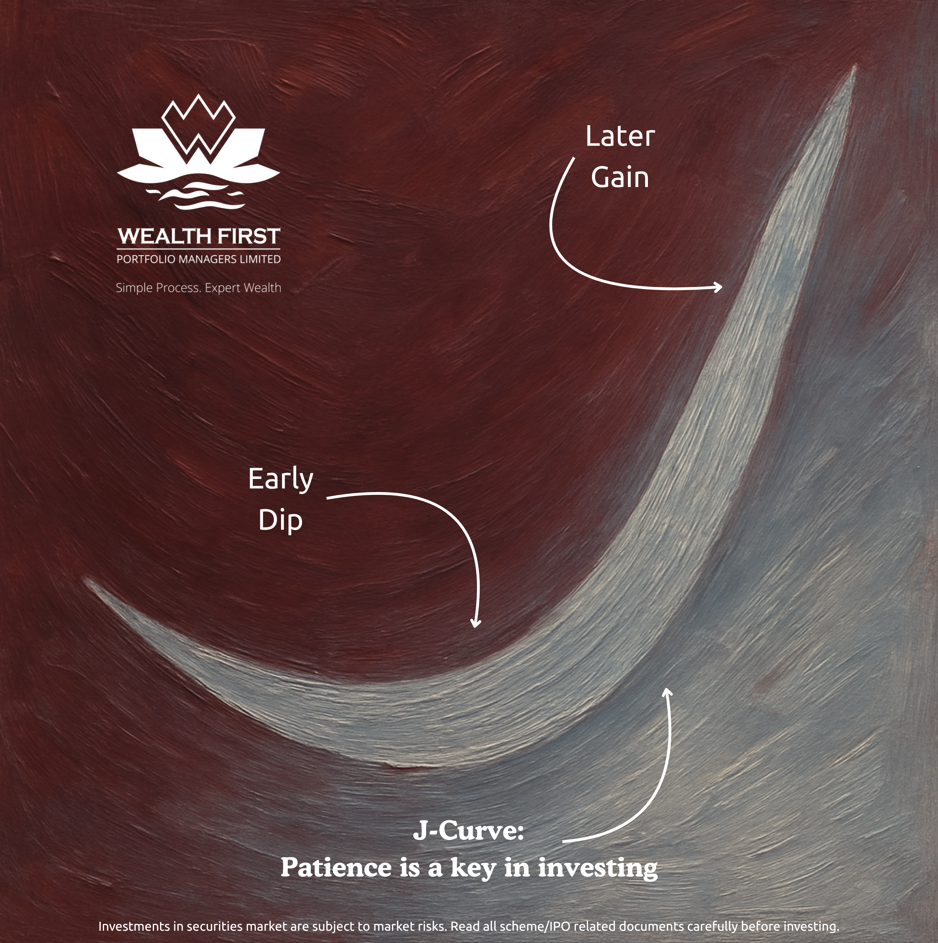

In simple terms, the J-curve describes a journey that dips before it rises.

If you draw it on paper, it looks like the letter “J” — performance or outcomes fall initially, flatten, and then start to rise steeply.

In finance, this shape often appears when investors adopt long-term strategies that require patience — like SIPs, asset rebalancing, or starting a new diversified allocation.

At first, you might see a decline in portfolio value, even though the strategy is sound. But over time, the curve recovers and moves upward, rewarding consistency and discipline.

Why Does the Dip Happen?

The early decline in the J-curve isn’t a flaw, but a possibility that there may be a decline in beginning followed by a reversed trend. Some reasons include:

- Market corrections: A new SIP started during a correction may first show negative returns.

- Transitioning portfolios: When shifting from, say, fixed deposits to equity-debt allocations, the early volatility can feel uncomfortable.

- Entry timing: Long-term plans started at temporary peaks might first move down before stabilizing.

The J-curve reminds us that good strategies don’t always look good immediately.

Where the J-Curve Might Appear

Although the J-curve is often mentioned in Economics, if we try to put the same concept in context of investing, it can appear in following cases:

- Systematic Investment Plans (SIPs):

When you begin SIPs during a market downturn, your portfolio may initially show a dip but you’re accumulating more units at lower prices. - Portfolio Rebalancing or PMS Allocations:

Introducing new asset classes can cause short-term underperformance as markets adjust, but over time, this diversification strengthens overall balance. - Switching from Savings or FDs to Market Instruments:

Moving from assured returns (like Fixed Deposits) to market-linked products (like Mutual Funds) often brings early discomfort. However, volatility is also often followed by a potential long-term growth.

These dips test investor patience but they are also the entry points of long-term wealth creation discipline.

When the J-Curve Doesn’t Apply

It’s important to note that not every investment will form a J-curve.

- In cases of poor-quality investments, weak business fundamentals, or unrealistic expectations, the curve might never recover.

- A falling curve that doesn’t rise could indicate deeper structural issues.

That’s why diversification, research, and regular reviews are essential in order to ensure that temporary dips aren’t confused with fundamental decline.

Staying Disciplined Through the Dip

The J-curve teaches one timeless principle: patience is not passive but strategic. Here are some behavioural guardrails to keep in mind:

- Don’t judge a 3-year plan in 3 months.

Long-term strategies take time to reflect their strength. - Focus on process, not just progress.

Evaluate consistency and alignment with goals, not only short-term numbers. - Stay diversified and review periodically.

Diversification helps smoothen dips, while periodic reviews ensure alignment with objectives.

True investing discipline is about enduring the discomfort that precedes growth.

Key Takeaways

- The J-curve shows how performance can dip before it recovers — a natural part of disciplined investing.

- Not all dips are bad; some are part of a healthy adjustment process.

- Staying patient, diversified, and informed helps investors navigate through the curve.

- The J-curve rewards consistency, not timing.

Investing, like growth itself, is often invisible at first — then exponential later.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, recommendation, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information.