Why the newest update feels more compelling than the soundest plan.

For months, Chandra had been working with a nutritionist and observing slow, steady changes, a practical meal plan, and enough flexibility to make it sustainable. The approach was working. His energy was better, the scale was moving gradually, and his routine finally felt balanced.

Then one night, while scrolling through short videos, an alarming headline flashed:

“New study reveals shocking truth: avoid these foods immediately.”

Chandra tapped it.

Then another.

And another.

Within minutes, he had fallen into a tunnel of “urgent” health advice — miracle diets, sudden warnings, lists of foods to cut instantly, new rules contradicting the old ones.

Each video seemed more dramatic than the last. Each influencer sounded more certain than his own nutritionist.

By midnight, Chandra was reworking his entire diet by removing staples, adding exotic ingredients, and planning a 7-day “reset” he had never heard of before that evening.

The plan he built with his nutritionist over six careful months evaporated in two hours of doomscrolling. The newest advice felt the most important. The latest headline felt the most correct.

By the next morning, his routine was unrecognizable, and unsustainable.

He wasn’t responding to science. He was responding to recency bias.

Understanding Recency Bias

Chandra’s shift is a textbook example of recency bias: the tendency to give disproportionate importance to recent information, while discounting older but more reliable knowledge.

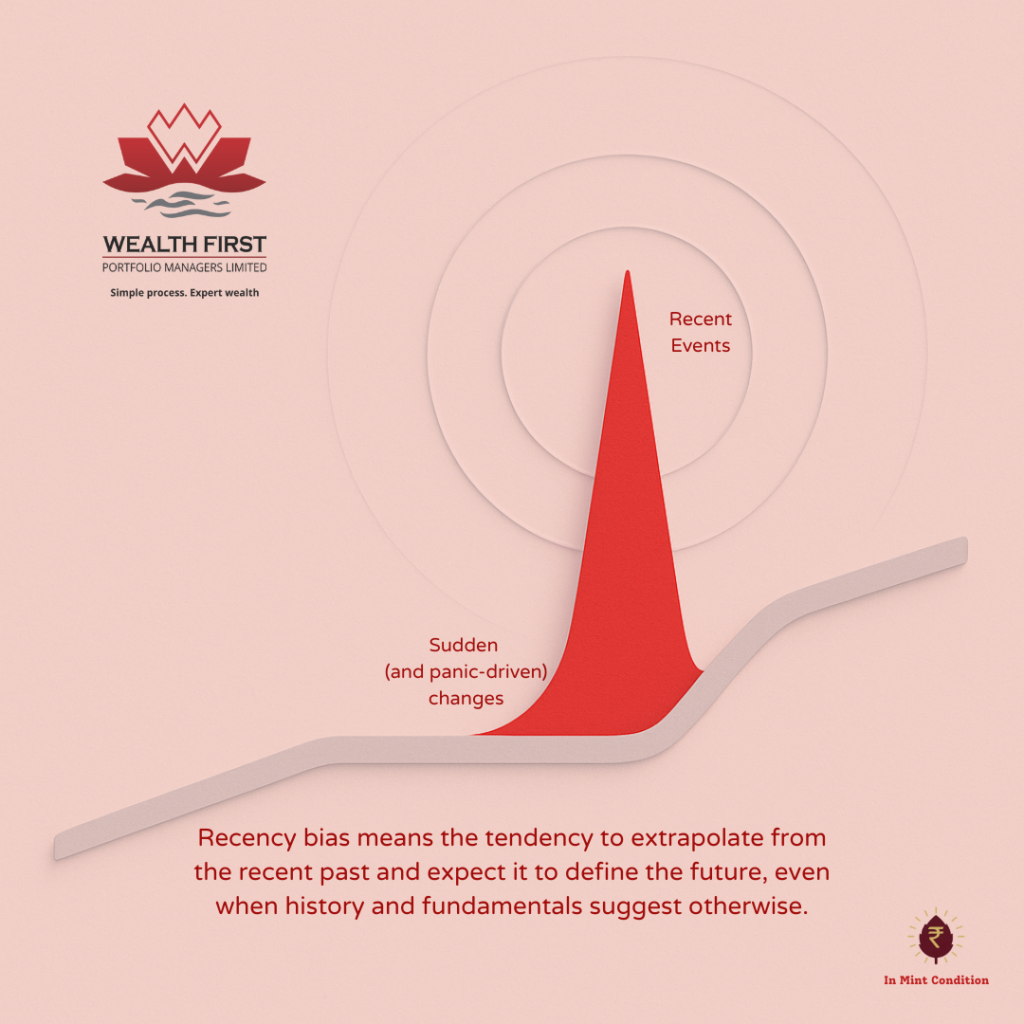

Breaking down the idea

- Recency: It refers to what has just happened, the most current events that occupy our minds.

- Bias: It is the distortion in judgement that arises when we let those recent events dominate our decision-making.

Together, recency bias means the tendency to extrapolate from the recent past and expect it to define the future, even when history and fundamentals suggest otherwise.

It is explained clearly elsewhere too:

- Recency bias is the tendency to place too much emphasis on experiences that are freshest in your memory—even if they’re not the most relevant or reliable.

- During a bull market, people forget bear markets. During a bear market, people forget bull markets. Recent events feel more important, but long-term data deserves more weight.

The recency effect causes people to remember the last items in a sequence best. This isn’t limited to memory. It affects judgement, habits, health decisions, and — very notably — financial behaviour.

What Recency Bias Does to Decisions

When recency takes over:

- We mistake novelty for truth

- We treat the latest headline as the strongest signal

- We override structured plans for sudden impulses

- We react emotionally instead of rationally

In Chandra’s case, months of balanced progress were overshadowed by a few dramatic clips filmed for virality, and not accuracy.

The science-backed plan he had carefully built was stable. But the latest video was fancy enough to grab the attention.

The difference is crucial:

Noise appears urgent. Knowledge appears slow.

But only one of them is reliable.

By the end of the week, Chandra was exhausted.

The new changes he made to his diet left him drained, irritable, and frustrated.

The promised “reset” never came. When he finally met his nutritionist, he expected a lecture. Instead, she simply asked, “What made you change the plan?”

He hesitated: “It felt like everything I knew until now was suddenly wrong.”

She nodded. “That feeling is not the problem. But, what you changed is neither holistic, nor suited to you. Your body didn’t change overnight. Only the latest advice did. And all latest updates do not need modifications to the plan we have created”

That evening, Chandra removed half of his influencers who didn’t add real value, turned off notifications, and returned to the slow & patient plan that actually worked for him.

The world didn’t stop giving him new “emergency health hacks.” But he stopped letting the freshest thing overpower the truest thing.

Key Takeaways

- Recency bias magnifies the latest piece of information, hence making it feel more important than long-term evidence.

- Doomscrolling narrows perspective, where urgency replaces accuracy.

- Stability beats novelty, as sustainable plans outperform sudden swings driven by fresh noise.

Read Next

- Wealth First Explains: Goal-Based Investing: How to Invest with Purpose

- Wealth First Explains: Inflation & Your Money: How Rising Prices Erode Savings

Disclaimer: The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information and concepts, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information. All articles contain no offer, inducement, or solicitation for account opening, investment, or trading activity. All characters, events and examples are fictional and used only for illustrative storytelling. Wealth First, its employees, and affiliates expressly disclaim any liability arising from interpretation or use of this material.