Wealth First explains why NAV is the heartbeat of every mutual fund and how it helps investors understand what their money’s really worth.

As we move deeper into the Wealth First Explains series, we now begin exploring some of the core concepts and ratios that define investing itself. And among the most fundamental ones — especially for mutual fund investors — is the Net Asset Value, or simply, NAV.

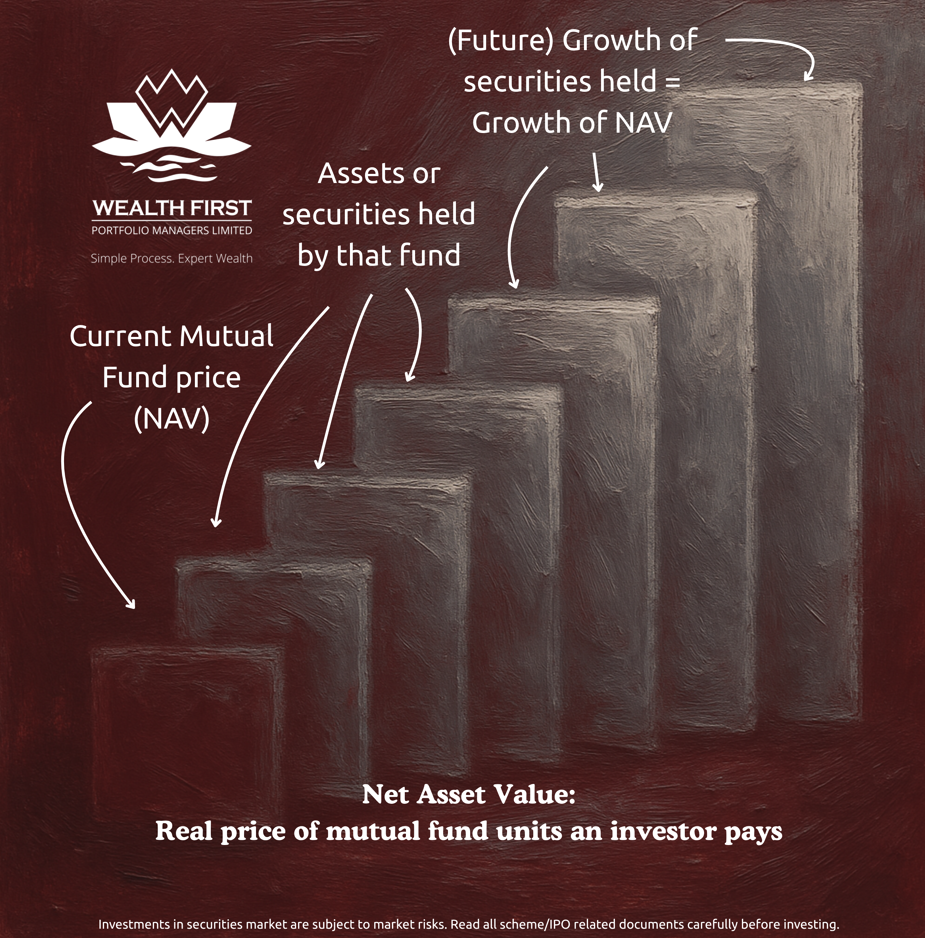

If mutual funds are the vehicles of wealth creation, NAV is their price tag. It tells you what your share of that vehicle is worth at any given moment.

What Is NAV?

The Net Asset Value (NAV) is the per-unit value of a mutual fund scheme.

It represents what each unit of the fund is worth after accounting for all its assets and liabilities.

Mathematically, it’s defined as:

NAV = (Total Assets – Total Liabilities) ÷ Number of Units Outstanding

In simple words, if a mutual fund’s total investments, cash, and receivables (after expenses) are worth ₹100 crore and there are 10 crore units issued, then the NAV = ₹10.

How NAV Works: The Daily Snapshot of Value

The NAV of a mutual fund changes every business day, reflecting how the underlying portfolio of securities performs in the market.

When markets rise and the fund’s holdings appreciate, NAV increases.

When markets fall, NAV decreases.

NAV is like a daily health report of the fund. It reflects what the fund is worth right now. However, a higher or lower NAV does not mean a fund is better or worse. It only tells you the price per unit, and not the potential for growth.

Example: Understanding NAV in Practice

Scenario 1 – Two Investors, Different NAVs

Let’s say two investors buy into two different mutual funds:

| Fund | NAV on Day of Purchase | Amount Invested | Units Allotted |

| Fund A | ₹10 | ₹10,000 | 1,000 units |

| Fund B | ₹50 | ₹10,000 | 200 units |

After one year, both funds grow by 10%.

| Fund | New NAV | Value After 1 Year | Return |

| Fund A | ₹11 | ₹11,000 | 10% |

| Fund B | ₹55 | ₹11,000 | 10% |

Even though Fund B had a higher NAV, both delivered the same return.

That’s because returns depend on performance, not NAV levels.

A low NAV doesn’t mean “cheap,” and a high NAV doesn’t mean “expensive.”

What Investors Should Understand About NAV

- NAV is not a stock price: Mutual fund NAVs don’t behave like stock prices that rise and fall intraday. NAVs are calculated once a day after market hours.

- NAV reflects the fund’s performance: It changes based on the movement of the underlying assets in the fund’s portfolio.

- NAV affects units, not returns: The number of units you get depends on the NAV, but your returns depend on how well the fund performs over time.

- NAV helps track fund progress: Comparing current NAV to purchase NAV helps you see your personal gain or loss.

Why NAV Matters for Investors

NAV gives transparency and structure to mutual fund investing. It allows investors to:

- Know exactly how their investments are valued daily.

- Compare fund performance over time.

- Redeem or switch units with clarity on current value.

It is the anchor of accountability for fund managers and the reference point of trust for investors.

In short, NAV is the mirror that reflects a mutual fund’s true worth.

Key Takeaways

- NAV (Net Asset Value) is the per-unit price of a mutual fund.

- It changes daily based on the fund’s asset performance.

- NAV doesn’t decide returns. Fund performance does.

- It helps investors track their investment’s growth transparently.

Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. The given example(s) is/are only for illustrative purposes only and hypothetical in nature. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information.