Wealth First Explains how tracking your income and expenses builds the foundation for smart investing.

Before you can start investing, you need to understand where your money is going. Think of budgeting as the first and most essential step toward financial freedom. We’ve already seen in our Inflation article how prices rise steadily over time. With stuffs getting costlier every year, tracking your income and expenses becomes not just good practice; it becomes a necessity.

Why Budgeting Comes First

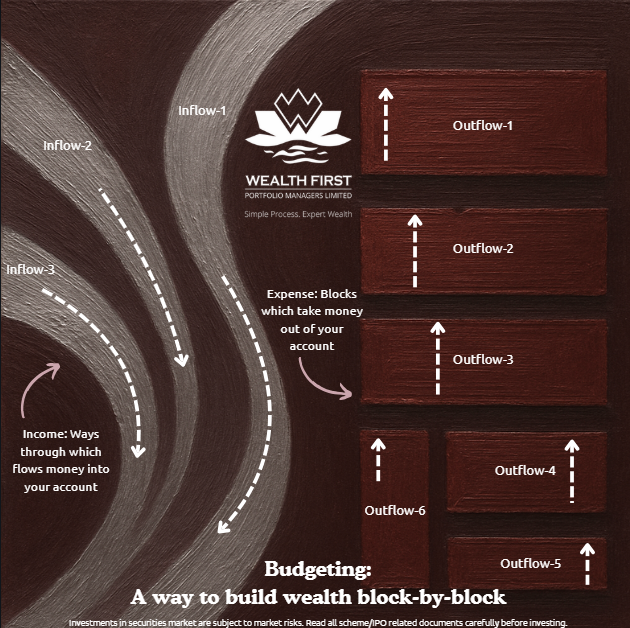

Budgeting is the process of managing your cash flows—the money coming in (income) and the money going out (expenses). It helps you:

- Stay aware of how much you earn, spend, and save.

- Identify unnecessary spending habits.

- Create room for investments, even from modest incomes.

- Build financial discipline for long-term wealth creation.

In simple words:

Budgeting tells you where your money goes, so you can decide where it should go.

How Budgeting Helps You Build Financial Discipline

Most people don’t realize how small, untracked expenses quietly erode their savings. Budgeting helps you gather true data on your financial life. It’s not about restricting yourself, but about creating awareness.

When you track every rupee, you begin to notice patterns:

- Subscriptions you don’t use.

- Impulse purchases that add up.

- Unnecessary loans or EMIs that strain cash flow.

By knowing your spending behaviour, you can start aligning it with your goals.

Example: The Power of Tracking Cash Flows

Let’s say you earn ₹80,000 per month. You track your expenses and find:

- Essentials (rent, groceries, utilities): ₹40,000

- EMIs: ₹20,000

- Lifestyle & leisure: ₹15,000

- Savings & investments: ₹5,000

Now, with this clarity, you realize you can reduce non-essential spending by ₹5,000 and redirect it into SIPs or your emergency fund.

👉 Use the Wealth First EMI Calculator to track all your existing loan repayments and see how much of your income is already committed. When you know both inflows and outflows, you gain control over your financial future.

How to Budget Without Complicating It

Budgeting doesn’t need complex apps or spreadsheets. Keep it simple:

- List your income sources (salary, rent, freelance, etc.).

- Track your expenses—use a basic notebook to list down.

- Categorize them as Needs, Wants, and Savings+Investments.

- Review monthly and set limits on discretionary spends.

- Automate savings or SIPs right after payday—this ensures discipline.

This system, also known as “Pay Yourself First”, helps you build savings before you start spending.

Budgeting = Awareness + Action

Budgeting isn’t about denying yourself; it’s about creating balance. It ensures that your lifestyle today doesn’t compromise your financial security tomorrow.

Once you start budgeting consistently, you’ll realize it’s not restrictive but empowering. It gives you the clarity to invest systematically and move closer to your goals every month.

Key Takeaways

- Budgeting is the first step before investing.

- Tracking income and expenses creates financial awareness.

- Helps identify savings opportunities and prevent lifestyle inflation.

- Simplicity and consistency are the keys—don’t overcomplicate it.

At Wealth First, we believe successful investing starts with understanding your own money flows.

👉 Use our Wealth Calculator to plan and track EMIs, SIPs, and investment projections.

👉 Talk to Us to get a customized plan that fits your lifestyle and goals.

📌 Disclaimer

The content shared by Wealth First is for general informational and educational purposes only and should not be considered as investment advice, research, or a solicitation to buy or sell any financial product. All information in emails, posts, and articles from Wealth First is intended solely to increase financial awareness. Past performance is not indicative of future results. All investments are subject to market risks, including possible loss of principal. Readers should consult their financial, legal, or tax advisors before making any investment decisions tailored to their personal circumstances. While utmost care is taken to ensure accuracy of information, Wealth First does not guarantee completeness, reliability, or timeliness, and shall not be liable for any direct or indirect loss arising from reliance on such information. By subscribing to or engaging with our content, you acknowledge that you are doing so at your own discretion, and that Wealth First is not responsible for individual investment outcomes.