Wealth First Explains 01

At Wealth First, we believe that informed investors make better decisions. Yet, in today’s world, the sheer number of investment options can feel overwhelming. That’s why we’re launching a new series: “Wealth First Explains” which is meant to simplify the whys and hows of investing.

Our goal is simple: to equip you with clear & practical knowledge so you feel confident about your financial choices. In each article, we’ll break down one important concept without jargon and noise so you can focus on what truly matters: building long-term wealth.

To kick off, we’re starting with one of the most powerful (yet often underestimated) concepts in investing: the power of compounding. Here’s a question for you: Have you ever wondered why financial experts keep telling you to “start investing early”? If you invest ₹10,000 today versus the same ₹10,000 ten years later, the outcomes will be drastically different, even if the invested amount looks the same. That’s the magic of compounding.

What is Compounding?

In simple words, compounding is when your money earns returns, and those returns also start earning returns over time. Think of it as a snowball rolling down a hill: it starts small, but as it gathers more snow, it grows bigger and faster. Compounding is, therefore, the process in which an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time.

Example: Two Friends, Two Different Journeys

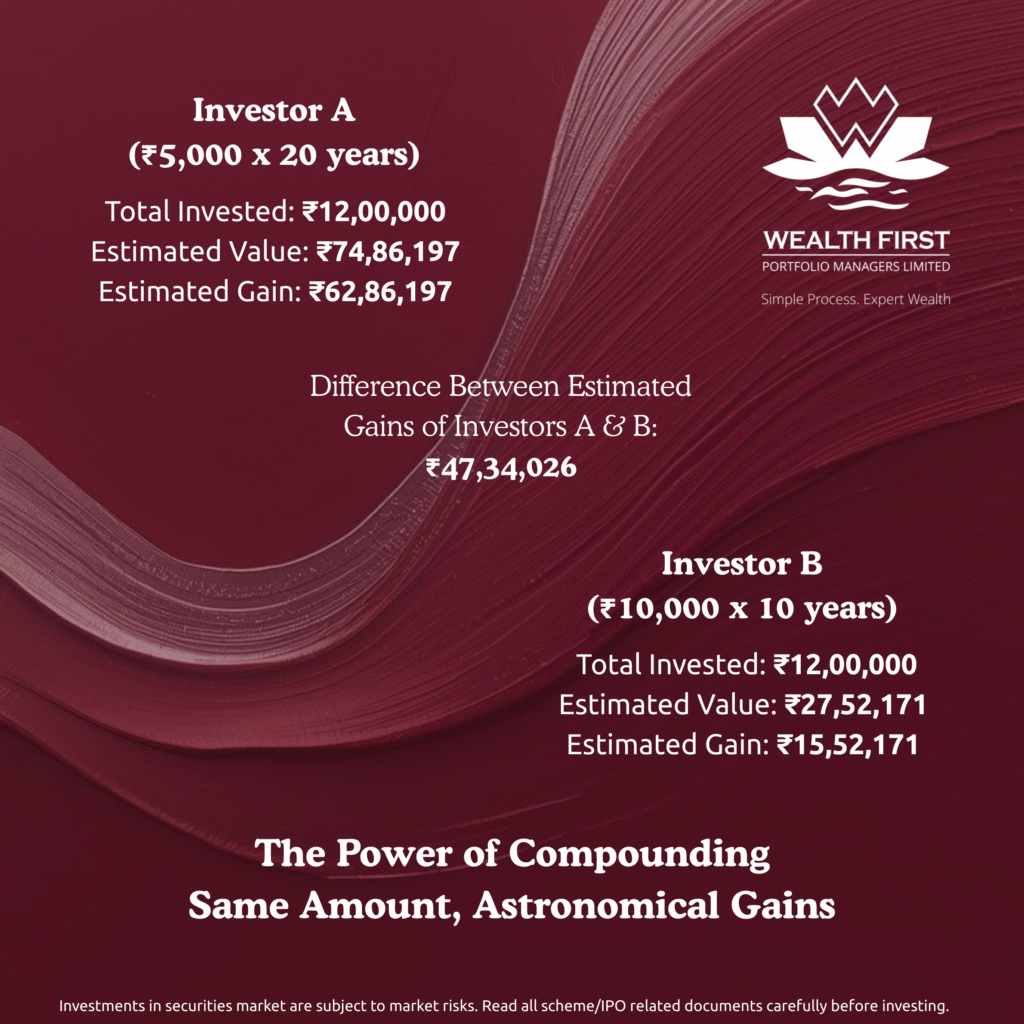

Let’s compare two investors—both disciplined, both investing the same total amount, but starting at different times.

- Investor A starts early: ₹5,000 per month for 20 years at 15% annual return.

- Investor B starts late: ₹10,000 per month for 10 years at the same 15% return.

Here are the results:

Even though both invested the same amount (₹12 lakh), Investor A walks away with nearly 3x the wealth simply by starting earlier. (Note: The above calculation was made using Wealth First’s free wealth calculator, which can be accessed here: Wealth Calculator

__________________________________________________________________________________

Enjoy the magic of compounding returns. Even modest investments made in one’s early 20s are likely to grow to staggering amounts over the course of an investment lifetime.

__________________________________________________________________________________

Why Time is Your Greatest Asset

The earlier you start, the more time your money has to grow. You don’t necessarily need to invest more; you just need to give your money enough time.

- Small, consistent investments beat large, delayed ones.

- Patience multiplies returns.

- The biggest advantage isn’t money—it’s time.

Key Takeaways

- Compounding works best with time + consistency.

- Starting early can help you build far greater wealth than starting late, even with the same total investment.

- Regular investing, even with smaller amounts, creates exponential growth over the long term.

👉 Talk to Us and explore how Wealth First helps investors like you in growing your wealth with clarity, discipline, and purpose.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial advice. Investment decisions are subject to market risks, and past performance is not indicative of future results. Please consult your financial advisor or wealth manager before making ny investment decisions.